Korean semiconductor giants—like Samsung and SK hynix—are shifting focus from traditional memory to AI-driven tech, such as HBM, amid global competition, US controls, and government support.

In the heart of the global technology revolution, few stories are as dynamic—or as consequential—as that of South Korea’s semiconductor industry. For decades, Korea has been a global powerhouse in memory chips. But during 2024 and 2025 the stakes changed. With the explosive rise of artificial intelligence, increasing geopolitical pressures, and shifting demand in electronics, Korea’s top semiconductor manufacturers are not just responding—they are reinventing themselves.

This is the story of how Samsung Electronics, SK hynix, and a cadre of smaller yet significant players are navigating one of the most competitive, capital-intensive, and politically entangled industries on Earth.

Beginning production in 2020, this is the site of V1, Samsung’s first semiconductor production line dedicated to the EUV lithography technology and produces chips using 7 nm process nodes and below. Image used courtesy of Samsung.

In recent years, the AI revolution—propelled by companies like NVIDIA, OpenAI, and Tesla—has fundamentally redefined what it means to be a semiconductor leader. No longer is it sufficient to dominate in traditional memory markets. Now, high-bandwidth memory (HBM), advanced packaging, cutting-edge logic chips, and cooling infrastructure are the new battlegrounds.

Samsung Makes Its HBM Moves

Samsung Electronics, long the king of DRAM and NAND, found itself playing catch-up in one critical area: AI memory. By early 2025, its smaller rival SK hynix had overtaken it as the world’s top DRAM vendor by revenue, largely due to a head start in HBM3E development. SK hynix’s dominance in this segment, which fuels AI servers and high-performance GPUs, sent shockwaves through the industry.

For Samsung, this was something like a moment of reckoning. In response, the tech giant moved aggressively. It secured NVIDIA certification for its 12-layer HBM3E chips and announced plans to launch HBM4 mass production by 2026. For a company that once dictated memory trends, regaining its footing in AI infrastructure became a top strategic priority.

But Samsung’s moves went far beyond memory. In a striking shift towards system semiconductors, the company secured a landmark $16.5 billion contract with Tesla to manufacture AI chips at its foundries in Texas. This wasn’t just a business deal; it was a strategic signal. Samsung intended not only to maintain dominance in memory but also to become a formidable force in logic chips and foundry services—fields long dominated by TSMC and Intel.

In September, SK hynix announced today that it completed development and finished preparation of HBM41, a next generation memory product for ultra-high performance AI, mass production for the world’s first time. Image used courtesy of SK hynix.

Meanwhile, SK hynix wasn’t standing still. It poured nearly $15 billion into expanding its DRAM plant in Cheongju, Korea, a decision fueled by soaring demand for AI chips. But it also looked westward, breaking ground on a $3.9 billion advanced packaging and R&D center in Indiana, U.S.—a strategic move to secure a foothold in the North American supply chain and hedge against global uncertainties.

A Broader Recalibration

These investments were more than just numbers on a balance sheet. They reflected a broader strategic recalibration. Korean chipmakers were no longer content with leading in traditional memory. They were preparing to shape the future of AI—from chip to cloud to cooling.

Beyond capital and contracts, innovation remained the core of these companies’ missions. As if to prove that point, during CES 2025 SK hynix revealed its roadmap for HBM4 and unveiled breakthrough server DRAM modules, enterprise SSDs, and memory with embedded processing capabilities (PIM). The company also highlighted its work on Compute Express Link (CXL), a next-gen interface that could redefine how CPUs, GPUs, and memory interact.

Samsung, for its part, pushed ahead with its own technology stack, not only in memory but in logic and thermal systems. Perhaps its boldest move was the acquisition of FläktGroup, a German leader in thermal and data center cooling systems. As AI servers consume exponentially more power, managing heat is becoming a bottleneck. Samsung’s foray into cooling technology signaled an awareness that the future of computing isn’t just about processing—it’s also about sustainability and efficiency.

Industry / Government Alignment

Driving this transformation is a strong alignment between industry and government. The South Korean government has unveiled plans for a mega semiconductor cluster in Gyeonggi Province, backed by investments exceeding 500 trillion won. Samsung and SK hynix are at the center of this initiative, working alongside smaller players like DB HiTek to build a vertically integrated ecosystem—one that spans logic, memory, packaging, R&D, and education.

Such cooperation isn’t merely patriotic. In a world where the U.S., China, and the EU are heavily subsidizing domestic chip manufacturing, Korea’s ability to maintain competitiveness hinges on strong public-private alignment. The MoaFab project, a collaborative platform for chip research and pilot production, exemplifies how the Korean government is empowering smaller firms to survive and thrive in this high-stakes environment.

Magnachip and DB HiTek

Indeed, while Samsung and SK hynix dominate the headlines, companies like Magnachip and DB HiTek are also pivoting decisively.

Magnachip, once focused on display driver ICs, is now divesting its display business to concentrate on power semiconductors—components that are essential for electric vehicles, renewable energy systems, and industrial automation. In doing so, it hopes to tap into higher-margin markets less exposed to the volatility of consumer electronics.

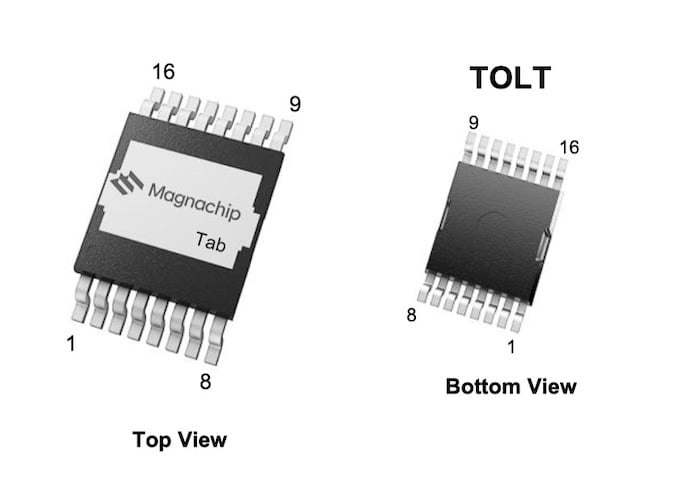

In July, Magnachip released its 80V MXT MV MOSFET, the MDLT080N017RH, featuring a TOLT (TO-Leaded Top-Side Cooling) package. The devices are aimed at motor control systems in E-Scooters and Light Electric Vehicles (LEVs). Image used courtesy of Magnachip.

DB HiTek, meanwhile, is strengthening its role as a specialized foundry partner for analog, power, and sensor chips. Through collaboration with MoaFab, it is gaining access to shared infrastructure and reducing its capital burden—a lifeline in an era of soaring fab costs.

These strategic realignments reflect a maturing industry: one where not every company needs to chase bleeding-edge logic or AI memory. Niche specialization, smart partnerships, and operational efficiency can offer equally sustainable paths to success.

Several Market Factors and Forces

US export controls are beginning to bite. In mid-2025, both Samsung and SK hynix were affected by tightened restrictions on shipping U.S.-origin semiconductor tools to their Chinese fabs. These rules are forcing Korean chipmakers to rethink their global supply chains and rebalance their manufacturing footprints—a complex, costly process.

At the same time, the global semiconductor market remains cyclical. While AI demand is surging, consumer electronics and legacy DRAM markets have softened. Oversupply risks linger, especially as Chinese players ramp up production. Even in high-margin sectors like HBM, competition is intensifying.

And then there’s the cost. Building an advanced fab can take upwards of $20 billion and several years. A single delay in yield improvement or customer certification can derail profitability.

Comparing Korea’s top two players—Samsung and SK hynix—reveals a fascinating divergence SK hynix has gained momentum by betting early and heavily on HBM and AI-centric memory. It is widely perceived as the HBM leader and is reaping the rewards in both revenue and reputation. Its Indiana project marks its commitment to global leadership beyond Korea’s shores.

Samsung, though temporarily behind in HBM, is leveraging its size, integration, and diversification to regain ground. Its Tesla deal, FläktGroup acquisition, and foundry ambitions reflect a multidimensional strategy—one that stretches from memory to logic, from chip to system.

Both paths are valid, of course. The next few years will show whether early focus or broad integration proves more sustainable.

A Critical Juncture for Korea’s Semiconductor Sector

As 2025 draws to a close, Korea’s semiconductor sector stands at a critical juncture. It’s no longer just a memory powerhouse. It’s transforming into a diversified, innovation-driven, and geopolitically agile tech ecosystem.

Samsung is racing to expand its foundry business, integrate thermal systems, and reshape its role in the AI age. SK hynix is cementing its status as the global memory leader and staking claims in packaging and AI R&D. Smaller firms are carving out specialized niches with strategic clarity.

Despite what’s written above, the big challenges still loom: geopolitical instability, cost inflation, execution risks, and fierce competition from the U.S., China, and Taiwan. Korea’s ability to retain its edge will depend on more than capital and capacity.

-

Tel

+86 180 2549 2789 -

Wechat

BOM

BOM Cart()

Cart() English

English Russia

Russia Korean

Korean